Daily Quizzes

Mock Tests

No tests attempted yet.

Select Category

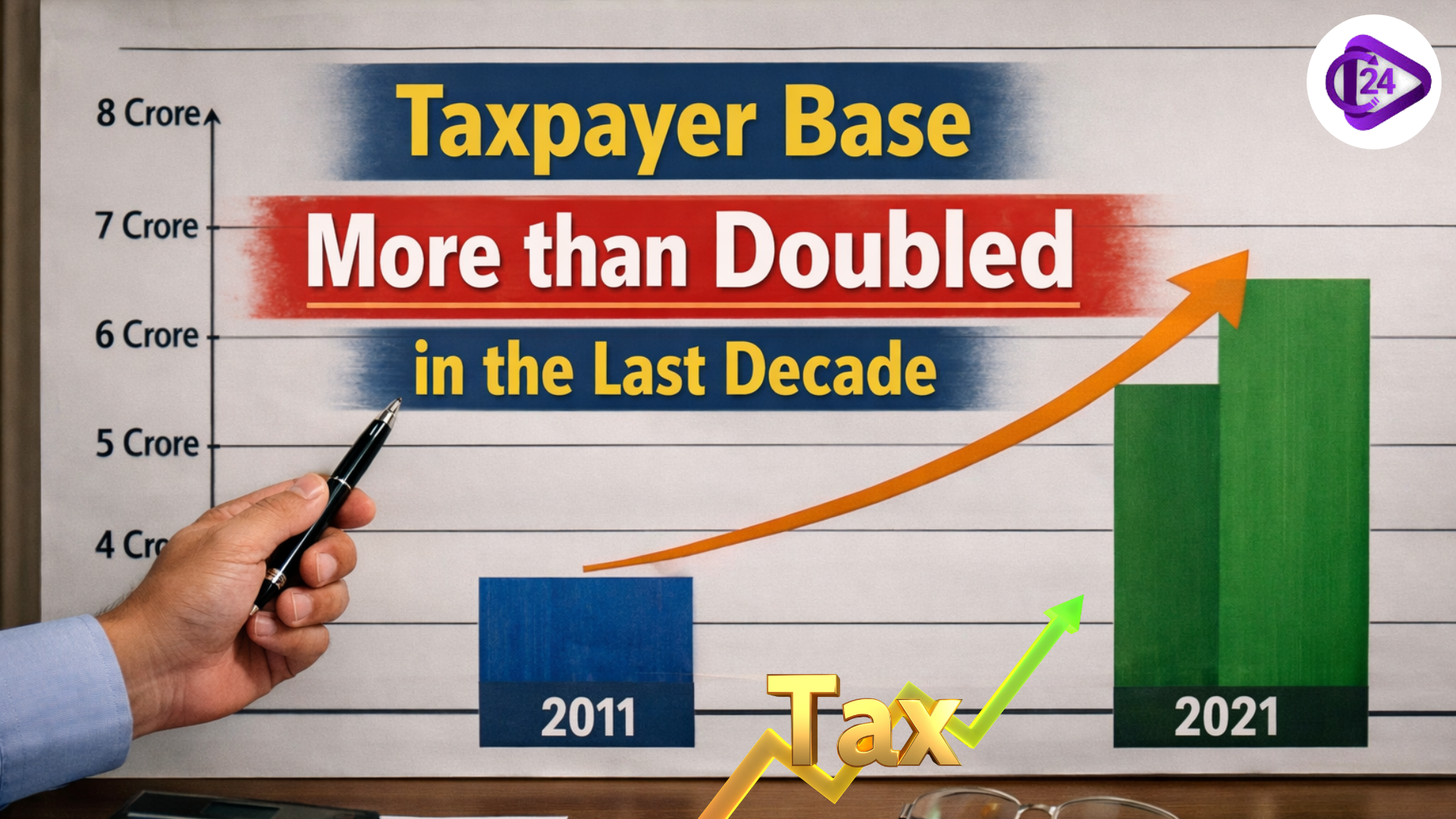

The taxpayer base in India has been growing tremendously over the last 10 years as the population of income tax filers more than doubled, showing a wider participation in the economy and the increases in adherence. According to the official statistics given by the Ministry of Finance, the number of people who submit tax returns is increasing at a steep rate, which indicates the greater involvement of citizens in the formal taxation process and the increased reporting of taxable incomes. This tendency indicates tighter enforcement, superior digital infrastructure for filing and compliance, and the increasing middle class whose income is growing. The growth of the tax base facilitates sustainable growth of revenues, and it also shows signs ofthe formalisation of the economy.

Why Has India’s Taxpayer Base Doubled Since 2014?

-

The number of taxpayers in India has increased by over 1.5 times over the last ten years, as the government records indicate that the number increased by approximately 9.37 crore in FY2,3 compared to 5.26 crore in FY14 in the income-tax bracket.

-

The size of the income tax returns is also increasing more and more, and this is an indication that there is a gradual increase in voluntary reporting and compliance with the income tax.

-

There has been growth in the Tax Deduction at Source (TDS), and this has assisted in an increase in the tax net by including more salaried and non-salaried earners in the formal system.

-

The systems of income-tax return filing have been simplified and entirely computerized and have facilitated compliance in the country and reduced the time spent on the process.

-

A rise in formal labour, an increase in incomes and economic growth have propelled more people over the taxable limit.

- The enhanced use of data analytics and information-sharing mechanisms by the Income Tax Department has enhanced monitoring and minimised underreporting.

-

The transparency and tax base growth policy has helped to increase direct tax revenues and the tax-to-GDP ratio by nearly ten per cent in the past decade.

Previous Year's Asked Questions on Tax

| Exam | Question | Answer |

|---|---|---|

| UPSC CSE Prelims (Economy – Budget & Taxes) | In India, the tax proceeds of which of the following as a percentage of gross tax revenue significantly declined over a period? (a) Service tax (b) Personal income tax (c) Excise duty (d) Corporation tax |

(c) Excise duty |

| UPSC CSE Prelims (Economy – Direct & Indirect Taxes) | Which of the following are indirect taxes? (a) GST, corporate tax; (b) customs duty, corporate tax; (c) income tax, GST; (d) GST, Customs duty |

(d) GST and Customs duty |

| UPSC CSE Prelims (Economy – Fiscal Indicators) | Consider: 1) Tax revenue as a percentage of GDP has steadily increased. 2) The fiscal deficit as a percentage of GDP has steadily increased. Which is correct? |

Neither statement is correct |

| SSC CGL (Economics – Taxation) | When was the Goods and Services Tax implemented in India? (a) 1 April 2018 (b) 1 July 2017 (c) 1 July 2018 (d) 1 April 2017 |

(b) 1 July 2017 |

| Banking Exams (IBPS/PO – Economy) | Which of the following taxes was subsumed after GST implementation? (a) Service tax (b) Income tax (c) Wealth tax (d) Estate duty |

(a) Service tax |

| State PCS (Economy – Direct Taxes) | Which of the following is a direct tax? (a) VAT (b) Excise duty (c) GST (d) Income tax |

(d) Income tax |

| CUET (Economics – GST Concepts) | Identify the incorrect statement: GST is a comprehensive indirect tax; it merged multiple taxes; it is destination-based; it became operational before July 2017. |

The incorrect statement is that GST became operational before July 2017 |

Conclusion (India’s Taxpayer Base Doubles in 10 Years)

The doubling of the taxpayer base in India in the last decade is a sign of greater formalisation of the economy and high compliance. The tax net has increased because of higher return filings, superior digital systems, and the enforcement level. The continuous increase is an indicator of an increase in income reporting, increased collection of revenues, and increased involvement of citizens in the fiscal system of the country.

SBI Strongest Indian Bank; HDFC Bank Leads in Brand Value

SBI Strongest Indian Bank; HDFC Bank Leads in Brand Value India’s New GDP Series: A Game-Changer for Accurate Economic Growth Measurement

India’s New GDP Series: A Game-Changer for Accurate Economic Growth Measurement Kerala Presents India’s First Elderly Budget

Kerala Presents India’s First Elderly Budget US Changes India Trade Deal Statement, Sparking Confusion

US Changes India Trade Deal Statement, Sparking Confusion Walmart Becomes First Retailer to Hit $1tn Market Value

Walmart Becomes First Retailer to Hit $1tn Market Value India's Union Budget FY 2026-27: Key highlights

India's Union Budget FY 2026-27: Key highlights Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van

Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van India Emerges as World’s Largest Rice Producer

India Emerges as World’s Largest Rice Producer Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets

Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets