The Reserve Bank of India reports that FDI coming into India has dropped by a huge margin, dropping almost 96%, to $353 million in the financial year 2024-25. Even though foreign investment into India was substantial, the reason for net FDI’s big decrease is that foreign businesses took out more money and Indian companies made more investments in other countries. Before the pandemic, FDI was increasing, but this has reversed since 2020 due to a change in where capital is sent, rather than a drop in interest from foreigners.

Context:

-

FDI into India fell by 96% to $353 million in FY25, mainly due to increased repatriation and Indian firms investing their profits overseas.

-

Strong figures for gross FDI show that interest remains among foreign investors.

Key Points

-

Net FDI means:

-

Net FDI results from the difference between gross FDI received and the money Indians send overseas, as well as what foreign companies invest at home.

-

-

Major decrease in foreign direct investment (FDI).

-

Moved from $44 billion in 2020-21 to just $0.35 billion in 2024-25.

-

Other than last year’s record, FY25 is down by almost 96% from the prior year’s total.

-

-

Factors Behind the Decline:

-

An expansion of money sent by foreign companies to their home countries.

-

More investments are being made abroad by Indian companies.

-

-

How Is FDI Gross?

-

Still going strong with interest in foreign investment remaining in India.

-

Lower net FDI is because of alterations in financial flows, not because foreigners have less confidence.

-

-

Between Now and the Pandemic:

-

Since 2020-21, net FDI has been on the decline because of changing global patterns in investment and transfer of profits to parent countries.

-

About FDI in India

What is Foreign Direct Investment?

-

FDI includes foreign companies entering a country to invest money, provide new technology, and share skills.

-

Organizations can begin new ventures, called Greenfield, or focus on acquisitions and expansions, known as Brownfield.

-

Employment of public procurement is regulated by the 'Guidelines for Procurement by Government of India', issued by DPIIT.

-

Existing pathways: automatic for most people and government-to-government for travel with the needed approvals.

-

Transferring FDI is restricted to the atomic energy, gambling, and real estate sectors.

How to Increase FDI:

-

India and the UAE sign a BIT to boost investor trust in both countries.

-

The Production Linked Incentive (PLI) scheme is helping to attract more FDI in the sector of white goods.

-

Making in India raised manufacturing FDI by more than half (57%) from 2014 until 2022.

-

Using the FIFP, FDI approvals are processed more smoothly.

-

PM Gati Shakti has resulted in better infrastructure, which draws more FDI.

Key Sectors of FBI Liberisation

-

The space sector can receive up to 100% foreign direct investment.

-

74% of defence-related FDI is the path route, and 100% is covered by the government route.

-

FDI was opened up in the pharmaceutical, commercial aviation, retail, insurance and telecom sectors.

-

The textile industry is helped by the National Technical Textiles scheme and the PLI support.

Top FDI Countries

-

Most of the FDI in Hong Kong comes from Singapore, Mauritius, USA, Netherlands and Japan.

-

After COVID, all investments from China and Pakistan to Sri Lanka are now handled only by the Government.

Benefits of FDI.

-

Helps create more jobs, improve the economy and build infrastructure.

-

Develops people’s work skills and encourages regional improvement.

-

Increases the amount of products sent out and maintains a predictable exchange rate.

-

Monopolies prevent competition and hold back new ideas which helps produce better results for consumers.

Concerns About Foreign Direct Investment:

-

Risks to the nation’s security in important industries.

-

The country is partly supported by foreign considerations.

-

Taking profits back abroad decreases the local economy’s gain.

-

Growing problems for local companies and mistreatment of employees.

-

The environment could suffer damage from some investments made by foreign businesses.

Way Forward:

-

Remove any unnecessary hurdles for starting a business and make rules easier to understand.

-

Support the growth of sustainable and green investments.

-

Help people improve their skills and get jobs.

-

Welcome FDI that brings new and innovative ideas to the country.

-

Work on infrastructure projects to help improve the environment for investors.

-

Make reforms in defence, space and renewable energy that are suitable for each sector.

Conclusion:

Most of the decline in FDI in the last fiscal year is due to more repatriation and foreign investments from India, rather than lower investment from overseas. Because of this trend, it’s clear how complicated capital movements can be, so more work is needed to maintain India’s appeal to foreign investors.

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks

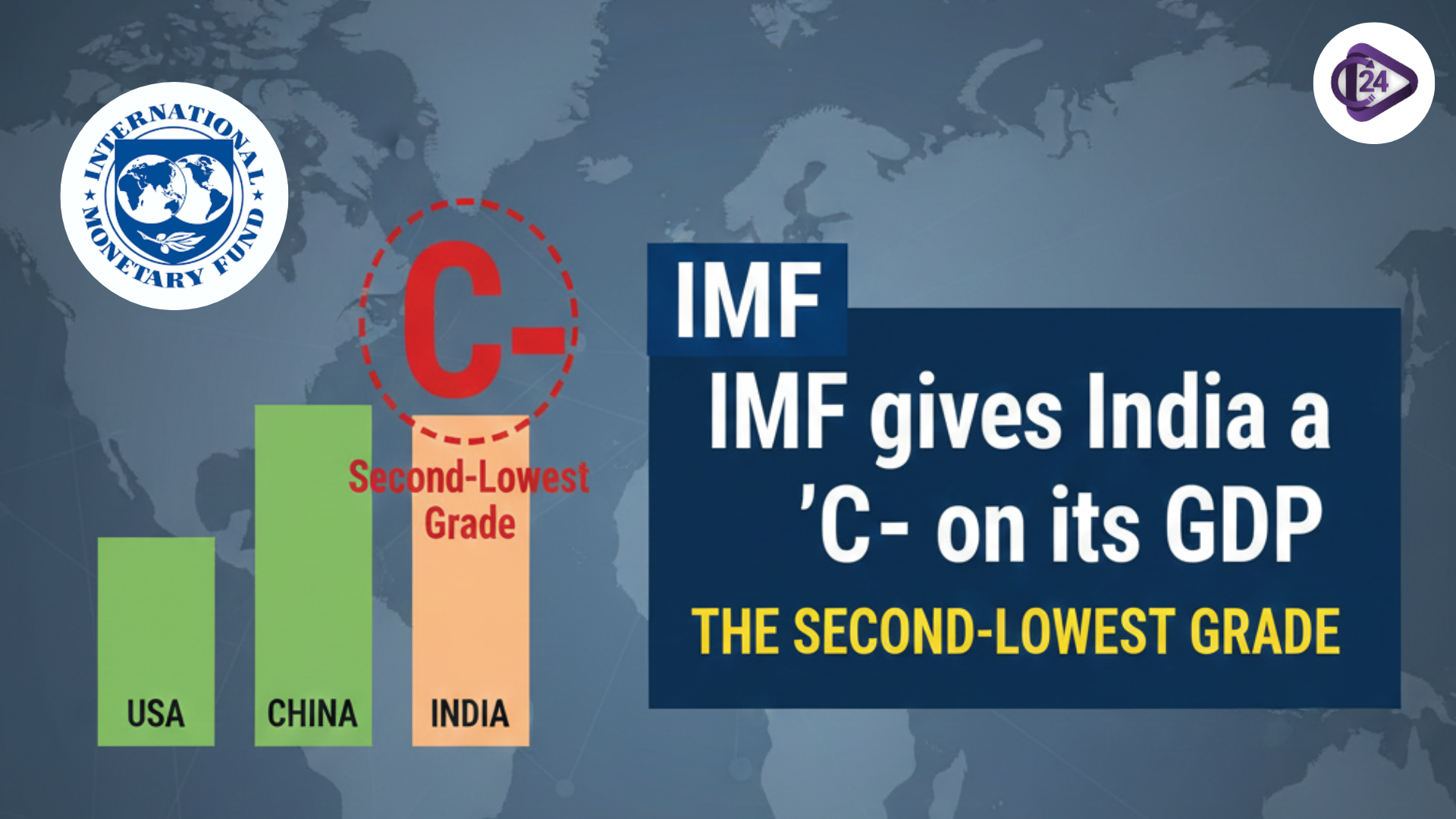

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade

IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade India Witnesses Rapid Surge in Ultra-Processed Food Consumption

India Witnesses Rapid Surge in Ultra-Processed Food Consumption HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index

HDFC Bank Secures the Top Rank in India’s 2025 Brand Value Index ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India

ASSOCHAM New President Nirmal Minda to Drive Industrial Innovation and Sustainability in India 8th Pay Commission 2025: Latest News, Salary Hike & DA Update

8th Pay Commission 2025: Latest News, Salary Hike & DA Update Sonali Sen Gupta Takes Charge as RBI Executive Director

Sonali Sen Gupta Takes Charge as RBI Executive Director Shram Shakti Niti 2025: India’s Future-Ready Labour Policy for Employment Growth

Shram Shakti Niti 2025: India’s Future-Ready Labour Policy for Employment Growth Secure UPI Transactions: RBI and NPCI Introduce Biometric Authentication

Secure UPI Transactions: RBI and NPCI Introduce Biometric Authentication Shirish Chandra Murmu Appointed as RBI Deputy Governor

Shirish Chandra Murmu Appointed as RBI Deputy Governor