Daily Quizzes

Mock Tests

No tests attempted yet.

Select Category

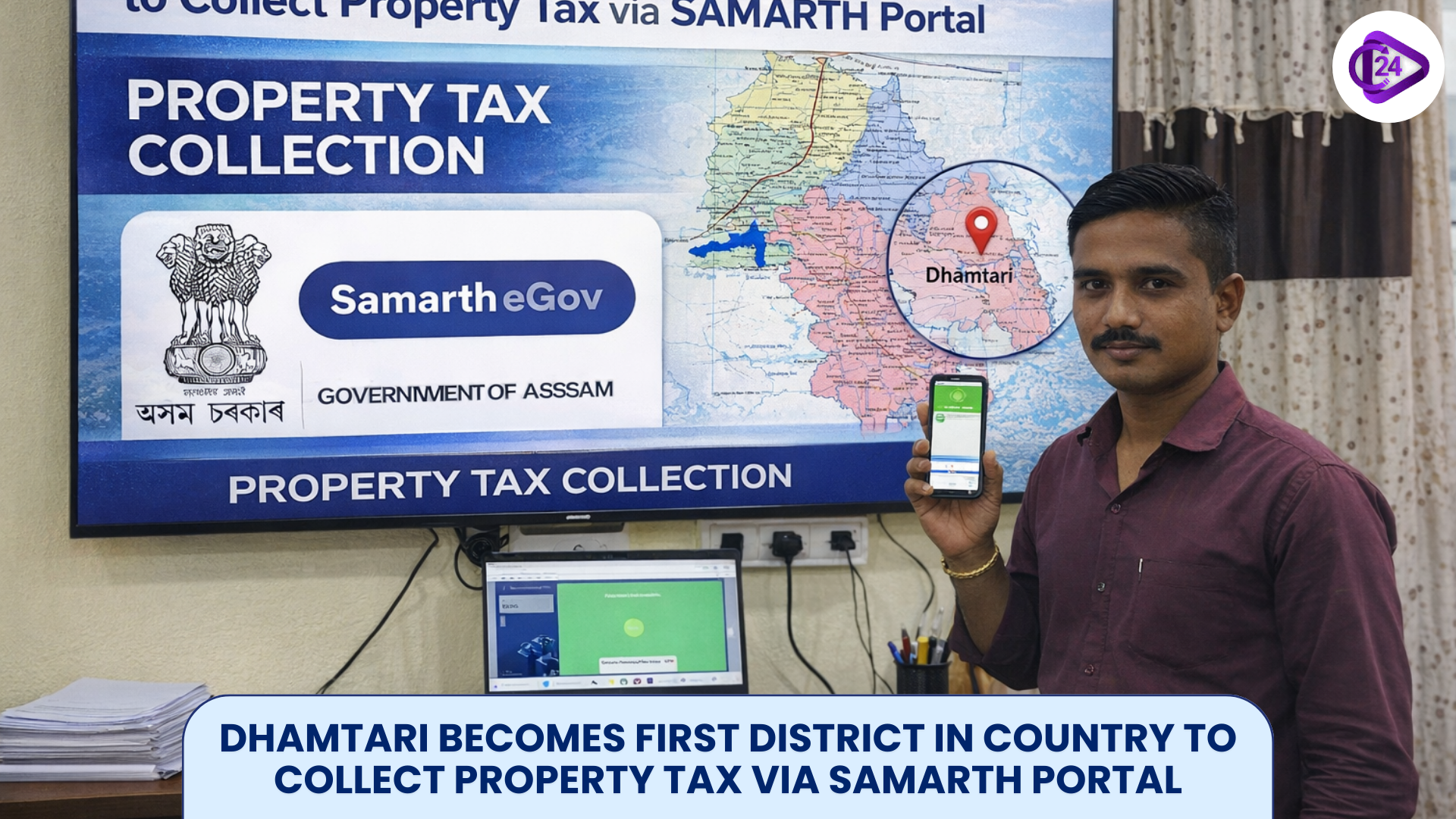

The Dhamtari district of Chhattisgarh was the first district in India to collect property tax through an online platform (the SAMARTH Panchayat portal), marking a major milestone in rural digital governance. Introduced in the Sankara gram panchayat, Nagri block, the program allows locals to remit property tax via a UPI payment gateway, making it easier to pay taxes and reducing administrative bureaucracy. It was first rolled out with a virtual presence of senior officials, and this is seen as a possible booster to transparency and the financial stability of gram panchayats and is an example that other jurisdictions can use to start using technology in collecting taxes.

Dhamtari Creates History with SAMARTH Property Tax

- Digital Governance Push: The project will be in line with the government's vision of Digital India and open local governments, where people can go cashless at the gram panchayat level.

- Pilot Launch: The system was initially launched in Sankara Gram Panchayat, Nagri block and citizens were able to pay property tax through an online payment system based on UPI.

- Citizen Convenience, another advantage is that citizens are now able to pay property tax at the convenience of their homes instead of needing to visit the panchayat offices, thus saving on time and not placing an excessive burden on the administrative system.

- Financial Empowerment: Digital tax collection enhances revenue collections and financial independence of gram panchayats, which makes it possible to plan the development works at the local level better.

- Transparency & Accountability: Online records will mean that the payments of taxes are monitored in real time, thus reducing leakages and enhancing the trust of the people in the local institutions.

- Administrative Support: The program was well received by senior officials as a model of national implementation in the rural parts of India.

- Scalability: The SAMARTH portal will be extended to all the gram panchayats of the district and then adopted in other districts and states.

- Relevance in Exam: This unfolding is relevant to Polity, Governance, Digital India, Panchayati Raj and Current Affairs parts.

Economics PYQs on Tax

| Exam | Year | Question | Options | Answer |

|---|---|---|---|---|

| UPSC CSE Prelims | 2016 | Which of the following is a direct tax? | A. GST B. Customs Duty C. Income Tax D. Excise Duty |

C |

| UPSC CSE Prelims | 2018 | Which tax is not subsumed under GST? | A. VAT B. Excise Duty C. Income Tax D. Service Tax |

C |

| UPSC CSE Prelims | 2020 | GST is best described as which type of tax? | A. Progressive tax B. Direct tax C. Destination-based indirect tax D. Regressive tax |

C |

| SSC CGL Tier-I | 2017 | Income tax is collected from whom? | A. Producer B. Consumer C. Importer D. Taxpayer directly |

D |

| SSC CGL Tier-I | 2019 | Which of the following is an indirect tax? | A. Corporation Tax B. Wealth Tax C. GST D. Income Tax |

C |

| SSC CHSL | 2020 | Burden of indirect tax falls on whom? | A. Government B. Producer C. Consumer D. Seller |

C |

| IBPS PO Prelims | 2018 | Which tax is included in the price of goods? | A. Income Tax B. GST C. Capital Gains Tax D. Corporate Tax |

B |

| SBI PO | 2021 | GST replaced which tax system? | A. Single tax system B. Cascading tax system C. Direct tax system D. Progressive tax system |

B |

| RRB NTPC | 2019 | Which tax is paid indirectly by consumers? | A. Income Tax B. GST C. Wealth Tax D. Gift Tax |

B |

| RRB Group D | 2022 | Who collects indirect tax from consumers? | A. Government directly B. RBI C. Intermediary/Seller D. Panchayat |

C |

.jpeg)

Conclusion

The Dhamtari district's becoming the first district in the country to pay property tax using the SAMARTH portal is a giant stride toward realising digital governance. The project leads to greater openness, increases the revenues of panchayats, and establishes a powerful example of cashless and technologically-oriented local governance throughout India.

Rajasthan Launches Homestay Scheme 2026: Eligibility, Subsidy Benefits

Rajasthan Launches Homestay Scheme 2026: Eligibility, Subsidy Benefits Goa Hosts World Ocean Science Congress 2026

Goa Hosts World Ocean Science Congress 2026 Vasai Cathedral Wins UNESCO Heritage Award 2025

Vasai Cathedral Wins UNESCO Heritage Award 2025 Vanjeevi Didi Scheme at Palamu Tiger Reserve

Vanjeevi Didi Scheme at Palamu Tiger Reserve Bharat VISTAAR

Bharat VISTAAR Maharashtra Village Passes Resolution to Become Caste-Free

Maharashtra Village Passes Resolution to Become Caste-Free Jaisalmer to Host India’s First Jain Chadar Mahotsav

Jaisalmer to Host India’s First Jain Chadar Mahotsav India's First ‘Cow Culture’ Museum to Open in U.P.'s Mathura

India's First ‘Cow Culture’ Museum to Open in U.P.'s Mathura Uday Kotak Appointed New Chairman of GIFT City, Replaces Hasmukh Adhia

Uday Kotak Appointed New Chairman of GIFT City, Replaces Hasmukh Adhia Delhi Govt Launches Lakhpati Bitiya Yojana for Girl Children

Delhi Govt Launches Lakhpati Bitiya Yojana for Girl Children