Daily Quizzes

Mock Tests

No tests attempted yet.

Select Category

Sonali Sen Gupta has been appointed as an Executive Director (ED) of the Reserve Bank of India. She has experience of more than thirty years in RBI and has worked in the areas of financial inclusion, supervision and human resources. She will be in charge of the Consumer Education and Protection, Financial Inclusion and Development and Inspection departments in her new position. Her rise indicates that RBI is focused on inclusive banking, consumer rights, and regulatory control, which supports the organisation in ensuring its ability to build the level of trust in the community and improve its performance.

Background and Responsibility

-

Indeed, it is effective on October 9, 2025, the day he was appointed Executive Director.

-

Past Position: Has worked as the Regional Director of Karnataka at the Bengaluru office of RBI.

-

Experience: More than 30 years working with RBI, in financial inclusion, banking regulations and human resource management.

Departments Overseen:

-

Consumer Education and Protection Division.

-

Finance Department Inclusion and Development.

-

Inspection Department

Highlights of the Reserve Bank of India

-

Founded: 1935 by the reserve bank of India act, 1934.

-

First Governor: Sir Osborne Smith (19351937).

-

Current Governor: Shri Sanjay Malhotra (since 2025).

-

Headquarters: Mumbai, Maharashtra.

-

Functions: financial regulation, currency issuance, monetary policy and development.

Conclusion

The appointment of Sonali Sen Gupta as the Executive Director of the Reserve Bank of India (RBI), starting October 9, 2025, highlights that she has a long history of financial inclusion, consumer protection, and banking regulation. India has signed the Global Partnership of Financial Inclusion (GPFI) program of G20 and the International Network of Financial Education (INFE) of OECD, which also portrays its commitment to global financial inclusion. In the RBI, she heads the vital departments, such as Consumer Education and Protection, Financial Inclusion and Development, and the Inspection, to make the banking sector in India more inclusive and leading in terms of banking regulation.

India’s New GDP Series: A Game-Changer for Accurate Economic Growth Measurement

India’s New GDP Series: A Game-Changer for Accurate Economic Growth Measurement Kerala Presents India’s First Elderly Budget

Kerala Presents India’s First Elderly Budget US Changes India Trade Deal Statement, Sparking Confusion

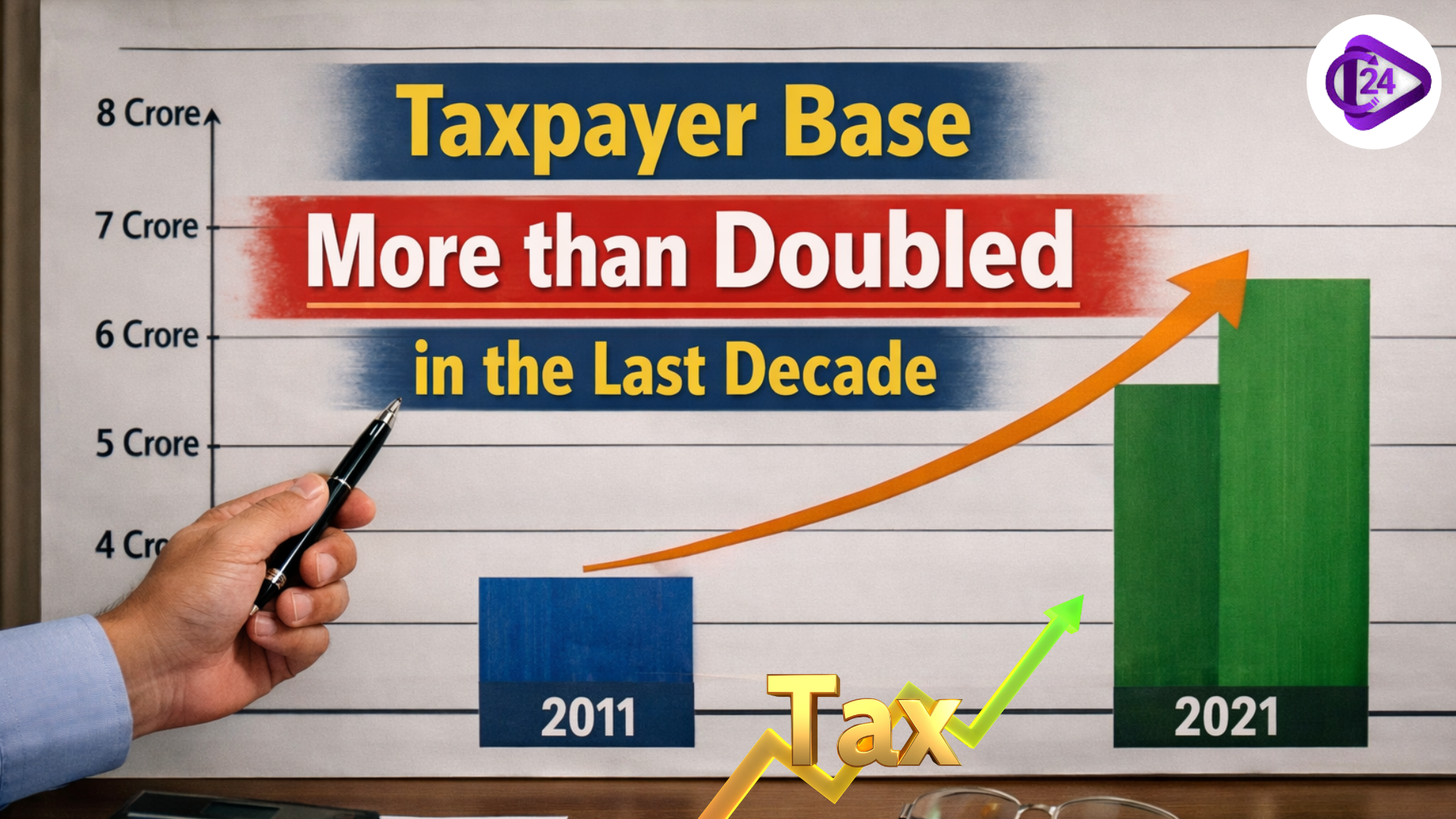

US Changes India Trade Deal Statement, Sparking Confusion Taxpayer Base More than Doubled in the Last Decade

Taxpayer Base More than Doubled in the Last Decade Walmart Becomes First Retailer to Hit $1tn Market Value

Walmart Becomes First Retailer to Hit $1tn Market Value India's Union Budget FY 2026-27: Key highlights

India's Union Budget FY 2026-27: Key highlights Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van

Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van India Emerges as World’s Largest Rice Producer

India Emerges as World’s Largest Rice Producer Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets

Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman

IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman