Daily Quizzes

Mock Tests

No tests attempted yet.

Select Category

The biometric authentication of shaking hands using UPI by RBI and NPCI has changed the digital payment ecosystem of India into a new era. The system enables consumers to authorize payments without the use of a traditional PIN because they can use it through fingerprints or even facial recognition. The biometric data is connected safely with the Aadhaar information of users, and authentication occurs at the devices, implying privacy and less fraud. The upgrade facilitates faster, safer, and convenient transactions, especially for customers who are not accustomed to using PIN-based transactions. UPI biometric will improve both inclusion and security by improving accessibility and ensuring greater confidence in the online payment market in India.

Important Key About Reserve Bank of India

-

Established on 1 April 1935 under the Reserve Bank of India Act, 1934.

-

It originally was a privately held bank of shareholders during which was nationalized on 1 January 1949.

-

Headquarters: Mumbai in Maharashtra.

-

First governor: Sir Osborne Smith; current governor: Sanjay Malhotra.

-

A central board of directors has 21 members.

-

Slogan: Satya meva jayate (Truth Alone Triumphs).

-

Supervises monetary policy, currency issues, and stability.

-

Regulates commercial banks, cooperative banks, and NBFCs.

-

Manages online payments, UPI, NEFT, and IMPS.

-

Secures financial inclusion, cybersecurity, and fraud.

UPI Impact in India and Worldwide: Growth, Users, and Economic Influence

-

UPI ( Unified Payments Interface ) was introduced by NPCI in 2016 as a method of providing secure digital instant payments.

-

In India, more than 500 million users by 2025.

-

Accepts peer-to-peer, merchant transactions, bill payment, and QR payments.

-

Bhutan was the first to adopt it internationally; it was recently expanded to Qatar, Trinidad and Tobago, and Japan.

-

To a large extent, grows the online economy in India improves financial inclusion and decreases cash dependence.

-

Carries out trillions of rupees of transactions in a day, making transactions more efficient and better in terms of delivering government subsidies.

-

Eccosystem promotes financial literacy, fintech innovation, and secure, quality digital ecosystems.

Conclusion

It has been a significant step in the Indian digital payment landscape, with RBI and NPCI introducing biometric authentication of UPI transactions. It allows fingerprint and facial recognition to eliminate the normal PINs, making it more secure, convenient, and fast. The innovation keeps the users safe against fraud and offers privacy due to on-device authentication, and enhances confidence in online transactions. Biometric UPI will enhance fiscal incorporation, lead to financial security, and strengthen India's presence as one of the countries with a successful approach to secure digital transactions as adoption increases.

India’s New GDP Series: A Game-Changer for Accurate Economic Growth Measurement

India’s New GDP Series: A Game-Changer for Accurate Economic Growth Measurement Kerala Presents India’s First Elderly Budget

Kerala Presents India’s First Elderly Budget US Changes India Trade Deal Statement, Sparking Confusion

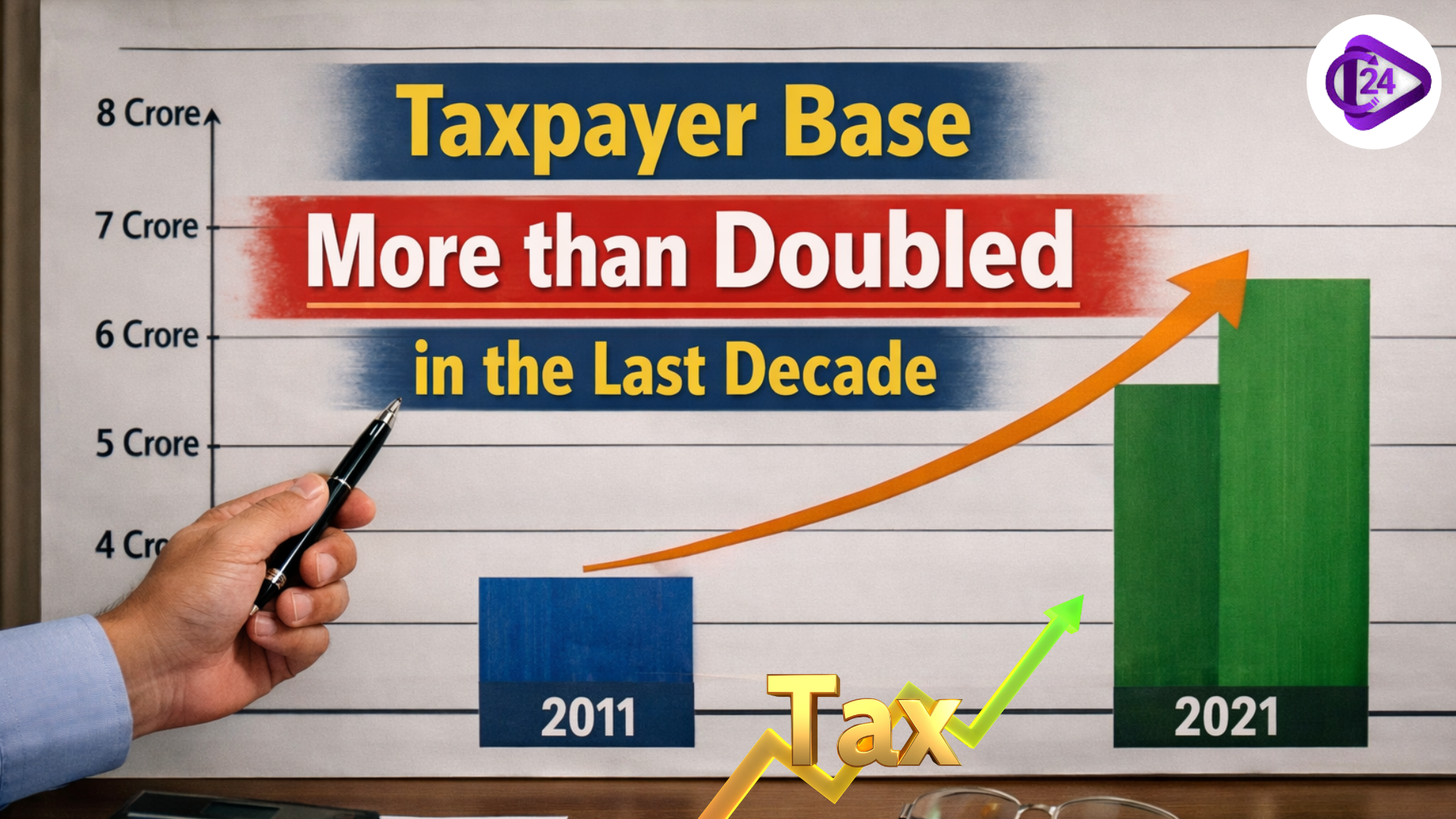

US Changes India Trade Deal Statement, Sparking Confusion Taxpayer Base More than Doubled in the Last Decade

Taxpayer Base More than Doubled in the Last Decade Walmart Becomes First Retailer to Hit $1tn Market Value

Walmart Becomes First Retailer to Hit $1tn Market Value India's Union Budget FY 2026-27: Key highlights

India's Union Budget FY 2026-27: Key highlights Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van

Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van India Emerges as World’s Largest Rice Producer

India Emerges as World’s Largest Rice Producer Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets

Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman

IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman