The Goods and Services Tax (GST) Council is the apex body responsible for decision-making on all matters related to the Goods and Services Tax in India. It was established under the 101st Constitutional Amendment Act of 2016 and plays a crucial role in shaping India’s tax framework to ensure a unified national market. The Council functions as a platform for cooperative federalism, bringing together the Union and State governments to collaborate on GST policy.

Constitutional Provisions of the GST Council:

-

Formation: Article 279A(1) mandates the President to constitute the GST Council within 60 days of the enactment of the 101st Constitutional Amendment.

-

Recommendations on Levy: Article 279A(5) allows the Council to recommend GST imposition on items like petroleum and aviation fuel.

-

Unified National Market: Article 279A(6) ensures that recommendations from the Council are aimed at fostering a unified national market.

-

Procedural Authority: Under Article 279A(8), the Council can set its own procedural rules.

-

Validity of Proceedings: As per Article 279A(10), the proceedings of the GST Council remain valid even in the case of vacancies or procedural errors.

-

Dispute Resolution: Article 279A(11) provides the GST Council with the authority to resolve disputes between the Centre and States regarding GST matters.

Composition of the GST Council:

-

Chairperson: Union Finance Minister heads the GST Council.

-

Vice-Chairperson: Elected from among the State Finance Ministers.

-

Members:

-

Union Minister of State for Revenue or Finance.

-

Finance or Taxation Ministers (or their nominees) from each State.

-

-

Permanent Invitee: Chairperson of the Central Board of Indirect Taxes and Customs (CBIC), who is a non-voting member.

-

Ex-Officio Secretary: Union Revenue Secretary.

Functions of the GST Council:

The GST Council's main functions, defined under Article 279A(4), include:

-

Taxes to be Subsumed: Deciding on Union, State, and local taxes to be merged under GST.

-

Goods and Services: Determining the goods and services subject to or exempt from GST.

-

Model Laws: Framing model laws related to GST, particularly for inter-state trade.

-

Thresholds: Setting turnover limits for GST exemptions.

-

GST Rates: Recommending the standard, floor, and band rates of GST.

-

Special Rates: Suggesting additional tax rates during natural calamities or disasters.

-

State-Specific Provisions: Making provisions for special treatment of Northeastern and hilly states.

-

Other Matters: Addressing any other matters related to GST implementation.

Working of the GST Council:

The GST Council operates based on the principle of cooperative federalism. Key aspects include:

-

Quorum: At least half of the members must be present for a meeting to take place.

-

Decision-Making: Decisions are made based on a three-fourths majority of weighted votes.

-

Vote Weightage:

-

Central Government: One-third of the total votes.

-

State Governments (collectively): Two-thirds of the total votes.

-

Major Outcomes of GST Council Meetings:

Since its formation, the GST Council has been instrumental in implementing several major decisions:

-

Dual GST Model: The adoption of the dual GST model (CGST and SGST) where both the Centre and States levy taxes.

-

Tax Slabs: Classification of goods and services into different tax slabs.

-

GST Compliance System: Launching an online GST compliance system for filing returns and making payments.

-

Input Tax Credit (ITC): Introduction of ITC to reduce cascading taxes.

-

Composition Scheme: Provision of simplified composition schemes to ease compliance for small businesses.

-

Rate Rationalization: Regular updates and adjustments to GST rates to reduce the tax burden on consumers.

Conclusion:

The GST Council has been a vital institution in shaping the tax landscape of India. By ensuring cooperative federalism, it has brought together both the Union and States to make decisions on matters critical to the nation’s economy. The Council’s efforts to streamline taxation, simplify compliance, and reduce the tax burden on consumers demonstrate its significant role in transforming India's economic structure under the GST regime.

India’s New Foreigners Act: Key Provisions and Exemptions

India’s New Foreigners Act: Key Provisions and Exemptions India Develops Rare Reference Material for Enhanced Anti-Doping Testing in Sports

India Develops Rare Reference Material for Enhanced Anti-Doping Testing in Sports India’s First Vulture Conservation Portal Launched

India’s First Vulture Conservation Portal Launched India needs more women judges in the Supreme Court

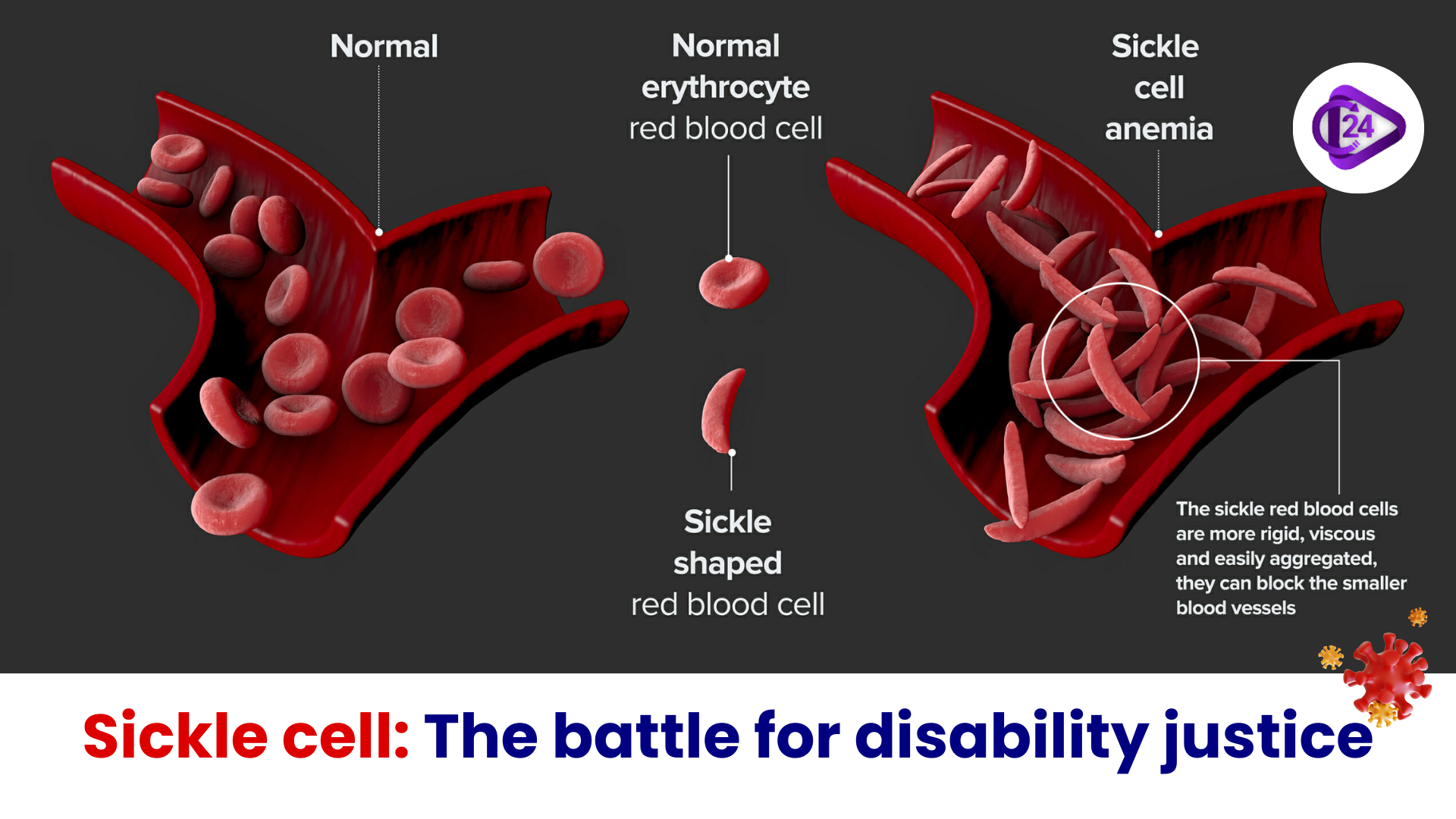

India needs more women judges in the Supreme Court Sickle cell: The battle for disability justice

Sickle cell: The battle for disability justice PM Modi receives first Made in India Vikram 32-bit Chip

PM Modi receives first Made in India Vikram 32-bit Chip Census 2027: First Digital Census with Geo-Tagged Buildings

Census 2027: First Digital Census with Geo-Tagged Buildings The rise and risks of health insurance in India

The rise and risks of health insurance in India NCERT Launches Bal Vatika TV and DIKSHA 2.0 on 65th Foundation Day

NCERT Launches Bal Vatika TV and DIKSHA 2.0 on 65th Foundation Day