Daily Quizzes

Mock Tests

No tests attempted yet.

Select Category

On September 3, 2025, the 56th GST Council meeting marked a turning point in the Indian history of taxes. As India looks forward to becoming Viksit Bharat by 2047 with the announcement of GST 2.0, the Council has provided a system of taxation that is more simplified, fair and growth-oriented. Such reforms extend beyond tax rates and forms, striving to transform the tax system into one that is transparent, efficient and easy to understand by citizens.

Key Reforms and Impact:

Simplification of Tax Slabs:

-

The various GST rates (5, 12, 18, and 28 percent) have been made into two major rates, namely 18 percent under the standard and 5 percent under essential goods. There will be a 40 percent de-merit rate on select goods.

-

This helps ease compliance, less confusion and business activities are more predictable.

Relief to Consumers:

-

Ordinary goods such as soap, shampoo, toothpaste and kitchenware have become 5% GST products.

-

Basic needs such as milk, paneer, chapati and paratha have been spared the GST.

-

Considerable reduction in the prices of packaged foods, noodles, chocolates, and beverages will allow reducing the cost to the consumers.

Health and Insurance Benefits:

-

With GST exemption on life and health insurance products, insurance will be more affordable, especially to low-income families and older populations, and social security will increase.

-

GST has also reduced essential drugs, devices and treatment related to cancer, rare and chronic disease and made healthcare more available.

Stimulus on Agriculture:

-

Farm machinery such as tractors receives only 5 percent GST as opposed to the 18 percent that fertilizer and other farm inputs previously received. This is in an effort to reduce the cost of cultivation, increase agricultural production and make farming more competitive.

-

Stimulus to Labour-Intensive Sectors:

-

The reduced GST on handicrafts, marble, granite and leather goods has boosted demand and job creation, and given the traditional industries a competitive advantage.

Major Reforms in the Strategically-Important Areas:

-

Textiles and Cement:

-

It is believed that the GST cut on man-made fibres and yarn to 5 percent will enhance competitiveness in the textile value chain.

-

The cut in the GST on cement to 18 percent will spur development in the housing and infrastructure sectors.

-

Green Growth:

-

The GST reduction on renewable energy-based devices and automotive parts will help in speeding up the green development and sustainability in India.

Institutional Strengthening:

GST Appellate Tribunal (GSTAT):

-

The GSTAT will enter into operation by the end of the year and will facilitate quicker settlement of disputes and enhance a more stable and open taxation system.

-

Operation and Compliance Improvements:

-

Provisional refunds, risk-based compliance tests, and harmonized valuation standards will also make the system simpler and uncertainty and compliance costs lower.

Roadmap and Implementation in future:

-

The gradual adoption beginning September 22, 2025, will remain revenue stable and will benefit businesses and consumers alike by having lower tax rates.

-

The government believes in proper implementation, creation of awareness as well as making sure that the fruit of the reforms are enjoyed by all citizens.

Conclusion:

GST 2.0 is a revolutionary process through which the taxation system in India is simplified. It is designed to empower consumers, farmers, workers and entrepreneurs with fairness, simplification and reforms that focus on growth. These reforms give India a better platform to grow in future, making it more competitive in the world with an equitable share of benefits in all sectors. The CII embraces these changes and will do its best to help them be put into practice.

Walmart Becomes First Retailer to Hit $1tn Market Value

Walmart Becomes First Retailer to Hit $1tn Market Value India's Union Budget FY 2026-27: Key highlights

India's Union Budget FY 2026-27: Key highlights Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van

Tripura Gramin Bank Launches India’s First Solar-Powered ATM Van India Emerges as World’s Largest Rice Producer

India Emerges as World’s Largest Rice Producer Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets

Government of India Launches ₹7,280 Crore Scheme for Rare Earth Permanent Magnets IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman

IIFL Finance appoints ex-RBI Deputy Governor B. P. Kanungo as Chairman India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA)

India and Oman Sign the Comprehensive Economic Partnership Agreement (CEPA) RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks

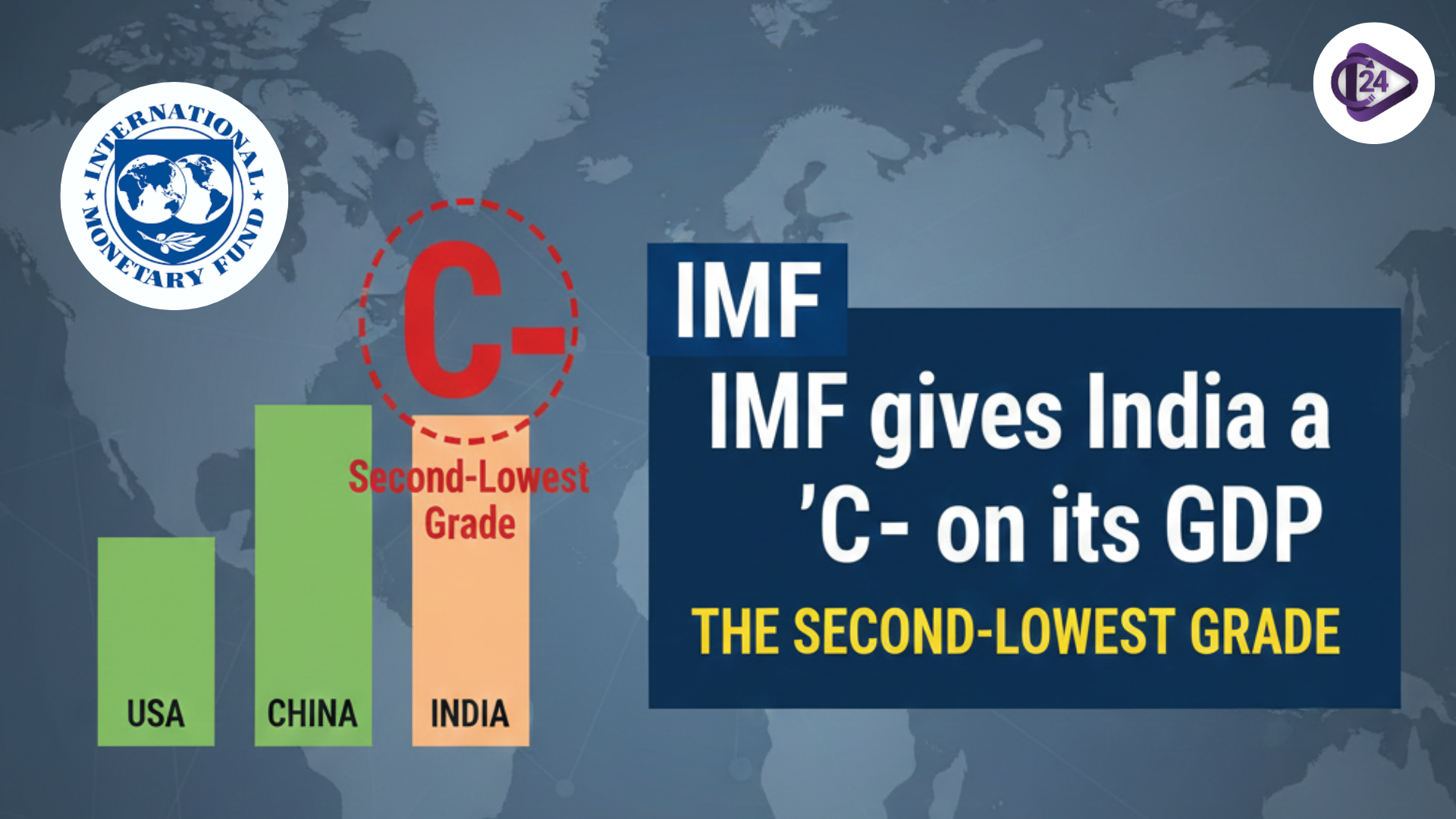

RBI Retains SBI, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade

IMF gives India a ‘C’ on its GDP and other national accounts data, the second-lowest grade India Witnesses Rapid Surge in Ultra-Processed Food Consumption

India Witnesses Rapid Surge in Ultra-Processed Food Consumption