WHO has initiated the “3 by 35” campaign, calling on countries to increase tax on tobacco, alcohol, and sugary drinks by 50 % by 2035 to stop the advancement of non-communicable diseases (NCDs). Such a measure will increase the number of NCD deaths that can be mitigated and yield significant funds to the health systems, especially those of low and middle-income countries. Under the initiative, the relevance of health taxes to advance the health of the population and as an incentive to social welfare programs is emphasized. Some countries already experienced the benefits of raising such taxes.

Context

-

The WHO initiative of setting more taxes on tobacco, alcohol, and sugary drinks by 50% by 2035, which is also known as the 3 by 35, is a strategy through which the body will contribute a large number of NCDs reductions results and will be providing income to the tune of US $ 1 trillion.

-

Nations are encouraged to channel this money into development of health mechanisms and security nets.

Key Details

-

Objectives of Health Taxes:

-

Minimize unhealthy products.

-

Create income to the community welfare and health.

-

-

Effect on NCDs:

-

The increase of 50 % of the price may potentially avert 50 million premature deaths within the next 50 years.

-

Case study: 34 % reduction in smoking of cigarettes in Colombia following increase in the taxation of cigarettes.

-

-

Revenue Generation:

-

This initiative may produce USD 1 trillion in the world within 10 years.

-

-

Challenges and Considerations:

-

Industry Opposition: There can be opposition to these policies by tobacco and beverage industries.

-

Regressive Tax Issues: Unless checked by subsidies, low income people might bear the brunt of the movement.

-

Economic Impact: The reduction in consumption may impact on the overall revenue levels.

-

Exemptions: Tax Exemptions, which make sense in a sector, may hurt the efficacy of the policies.

-

-

Health Systems objectives:

-

Raise universal coverage and prevention.

-

Exploit the opportunity of supporting SDG 3 at a level that will help in reducing NCD mortality by a third by the year 2030.

-

About

Definition of Health Tax:

-

A health tax refers to a duty charged on unhealthy goods such as alcohol, tobacco, and sweet drinks with the purpose of cutting down on their consumption and raising revenue to fund health and social welfare initiatives.

Goal of the Initiative:

-

Reduce NCDs: Voluntarily cut on the use of harmful products, thus alleviating the number of premature deaths.

-

Illustration: in Colombia the tax raised on cigarettes by 10 %age points resulted in a 34 % decline in consumption.

-

Make the Revenue Mobile: raise another $1 trillion worldwide in an additional 10 years, which could be invested in infrastructure and public health.

-

Empower Health Systems: Use the revenue to finance universal health coverage, preventive interventions and social protection.

-

Contribute to the achievement of the target related to NCD mortality, to decline by one-third (33%) before 2030 (SDG 3)

Influence of Increase in Tax:

-

Almost 140 countries have increased tobacco taxes between 2012 and 2022, and these changes are on average 50 % inflation-adjusted price rise indicating that the magnitude of change is possible.

-

A single 50 % price hike will block as many as 50 million premature deaths within the next 50 years.

Problems and Issues:

-

Industry Lobby: Tobacco companies, alcohol drink and beverage makers may lobby against such taxations thereby making the process be delayed or having poor policies.

-

Regressive Tax: The taxes on health may have a regressive impact particularly on lower income groups without adopting specification based assistance or subsidies.

-

Revenue Volatility: The decrease in consumption can cause tax revenues to become erratic, and this factor might affect long-run health system stability.

-

Tax Exemptions: Tax increases may not be effective through the already signed long-term contracts with industries.

Way Forward:

-

Nations have been requested to establish general large-scale health taxation and prevent industry-related exemptions.

-

The revenues must be injected into social protection, education and public health especially the vulnerable groups.

-

Alliances across sectors, including the civil society, are essential to achieving long term effect.

Conclusion

The 3 by 35 Initiative is a new policy change leading towards the utilization of health taxes as a means of promoting the welfare of the population. Governments should be urged to adopt whole health systems of taxations to spend the money gained into healthcare and social support particularly of vulnerable groups.

Maldives Achieves Landmark Success in Protecting Newborns from HIV, Hepatitis B, and Syphilis

Maldives Achieves Landmark Success in Protecting Newborns from HIV, Hepatitis B, and Syphilis UN Human Rights Council Elections: India Wins Membership for 2026–2028

UN Human Rights Council Elections: India Wins Membership for 2026–2028 Henley Passport Index 2025: Singapore Tops, India Rank 85

Henley Passport Index 2025: Singapore Tops, India Rank 85 Palau Hosts World’s First Live Underwater Interview: A Historic Event

Palau Hosts World’s First Live Underwater Interview: A Historic Event First Indian Mrs Universe 2025: Sherry Singh’s Inspiring Journey and Triumph

First Indian Mrs Universe 2025: Sherry Singh’s Inspiring Journey and Triumph India Promotes PM-KUSUM Solar Scheme to Boost Africa’s Renewable Energy Goals

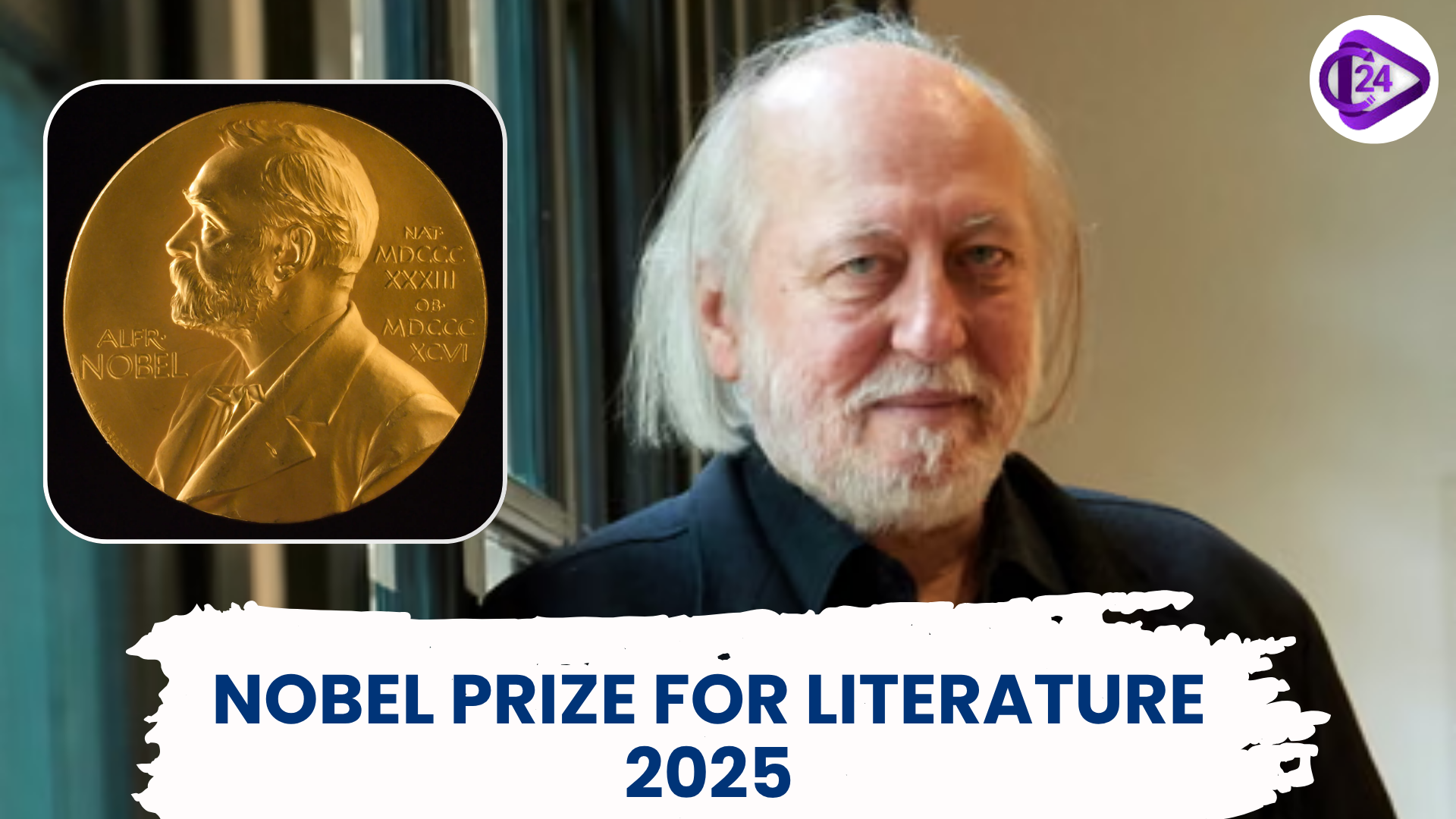

India Promotes PM-KUSUM Solar Scheme to Boost Africa’s Renewable Energy Goals Hungarian Author László Krasznahorkai Wins 2025 Nobel Prize in Literature

Hungarian Author László Krasznahorkai Wins 2025 Nobel Prize in Literature Philippines Earthquake Triggers Tsunami Warning: Coastal Areas Urged to Evacuate

Philippines Earthquake Triggers Tsunami Warning: Coastal Areas Urged to Evacuate Starmer arrives in India with a large business delegation in tow

Starmer arrives in India with a large business delegation in tow Nobel Prize in Physics 2025 Awarded to Three Leading Researchers

Nobel Prize in Physics 2025 Awarded to Three Leading Researchers