The GST council will deliberate on the move to cut down items in the 12% tax bracket in their next meeting that is expected to be held in July 2025 due to held-up meetings. The argument that stands out as one to discuss is whether to eliminate the 12%. slab as part and parcel of the rationalization and simplification of rates. Taxation of service intermediaries is also on the agenda of the council which may relieve the sector of heavy taxation. Such verdicts have the potential to introduce tax waiver measures that run into thousands of crores and which will have an effect on business and consumers alike on an Indian scale.

Context

-

In its next meeting, the GST Council will discuss the possibility of reviewing the 12% slabs and also, on the taxation of service intermediaries.

-

The changes may result in reduced taxation rates and even magnificent reprieve to the service sector.

Key points

An Meeting Agenda:

-

Rate Rationalization:

-

Recommendation of reducing or removing this 12 % GST slab

-

To simplify to four principal slabs: 0%, 5%, 18%, 28%

-

-

Taxation Service Intermediaries:

-

Reconsideration of 18% GST on intermediaries that will provide the service to clients abroad

-

May relieve and enhance export competitiveness harmonizing tax levels

-

Effects of a Reduction/Removal of the 12% Slab:

-

The 12% items can be transferred to 5% or 18% and compliance made easy

-

May limit the availability of input tax credit (ITC) by manufacturers

-

Undercharge on utilitarian products such as toothpaste and soap

Significance

-

Manufacturers Worries:

-

ITC loss in case of shift to 5% slab

-

Possible rise in the input costs

-

The variation on sectors could be high with FMCG and consumer goods being the highest affected.

-

-

Relief in Service Sector:

-

Negotiating the relaxation of tax regulations of service intermediaries

-

Will lower the total tax liability and increase outsourcing business internationally

-

Conclusion

The next meeting of the GST council can bring a significant simplification to the Indian taxation system, as the council is considering dropping the 12 percent tax bracket and changing the taxation on service intermediaries. These resolutions may help minimize the taxation rates thus ensuring that the GST structure would be effective and also recognize the objections of the industries regarding the input tax credits. Nevertheless, these reforms should not be one-sided but should strike a balance between the needs of the consumers, manufacturers and the service sector so as to pioneer a long-term economic increase.

India’s Pesticide Market Sees Major Shift Towards Herbicides

India’s Pesticide Market Sees Major Shift Towards Herbicides India as the 5th Largest Global Aviation Market: Significance, Trends, and Challenges

India as the 5th Largest Global Aviation Market: Significance, Trends, and Challenges Textile Sector as India’s Strength: Role in Economy, Culture, and Innovation

Textile Sector as India’s Strength: Role in Economy, Culture, and Innovation India’s Clean Energy Paradox: Installed Capacity at 50%, But Supply Still Below 30%

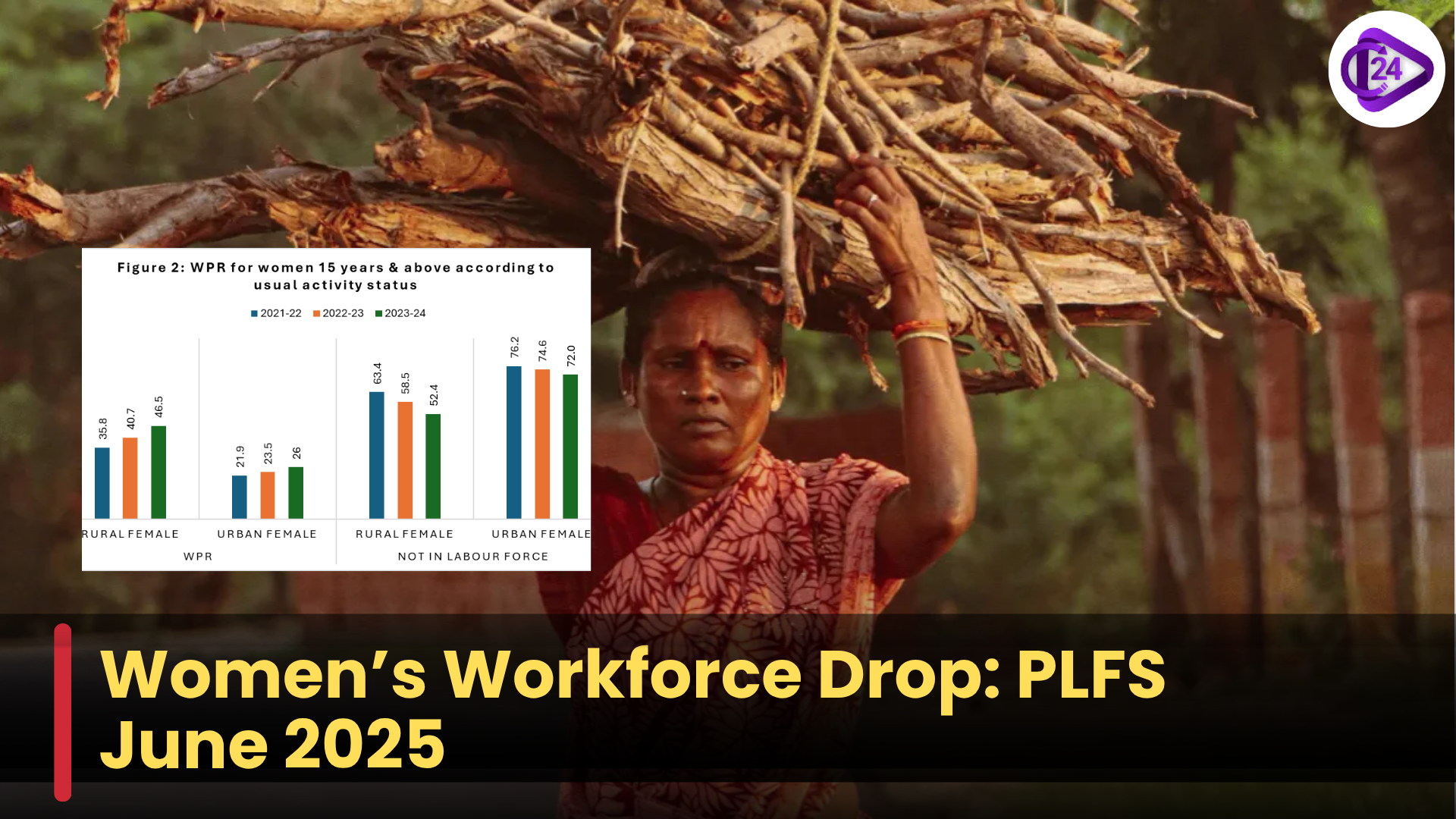

India’s Clean Energy Paradox: Installed Capacity at 50%, But Supply Still Below 30% Drop in Women’s Labour Force Participation in India: PLFS June 2025 Highlights

Drop in Women’s Labour Force Participation in India: PLFS June 2025 Highlights Uttarakhand Cabinet Approves Geo-Thermal Energy Policy 2025

Uttarakhand Cabinet Approves Geo-Thermal Energy Policy 2025 Namibia to Become First African Country to Roll Out Digital Payments System Based on UPI

Namibia to Become First African Country to Roll Out Digital Payments System Based on UPI India Targets $300 Billion Bioeconomy by 2030: Dr. Jitendra Singh Unveils Vision at World Bioproduct

India Targets $300 Billion Bioeconomy by 2030: Dr. Jitendra Singh Unveils Vision at World Bioproduct Cabinet Approves ₹99,446 Crore Employment-Linked Incentive Scheme

Cabinet Approves ₹99,446 Crore Employment-Linked Incentive Scheme Railway Fare Hikes Effective from July 1: 2 Paise per Km for AC, 1 Paise for Non-AC Travel

Railway Fare Hikes Effective from July 1: 2 Paise per Km for AC, 1 Paise for Non-AC Travel